Here are a few of my takeaways from reading this article.

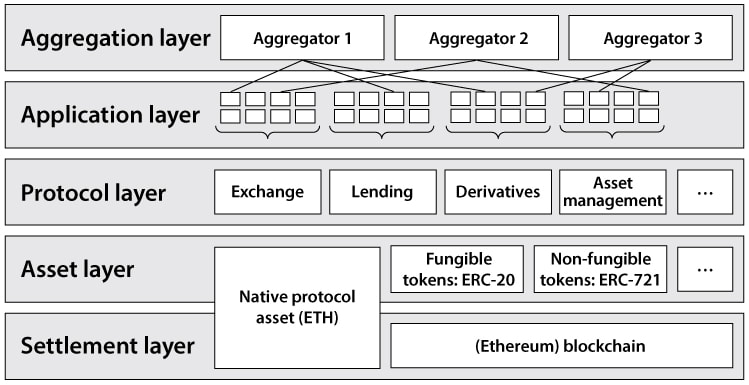

DeFi replicates existing financial services in a more open and transparent way. In particular, DeFi does not rely on intermediaries and centralized institutions. Instead, it is a blockchain-based financial infrastructure with open protocols and decentralized applications (DApps). Besides a rich instruction set DApps or smart contracts can also acts as custodian for crypto assets.

(DApps or smart contract theoretically could be any arbitrary computer program since they run on Turing complete blockchains (all but Bitcoin); although they are very inefficient. The ability to run more complex smart contracts is one of the biggest differences between Bitcoin and Ethereum block chains. Blockchains like Solana are designed to address the inefficiency or scalability problems of blockchains like Ethereum).

Native protocol crypto assets (BTC, ETH or cryptocurrencies ) are used to operate the blockchain.

Crypto assets that are tokens are units of value that blockchain based organizations or projects develop on top of existing block chain networks. Token standards include ERC-20 for tokens which can interoperate with Ethereum's ecosystem of decentralized apps. ERC-720 are non-fungible tokens (NFTs) used to tokenize ownership of any arbitrary data. For example they can be the digital representation of a physical object such as a piece of art.

This means that tokens can serve a variety of purposes: including governance tokens for decentralized autonomous organizations (DAO), tokens that allow the holder to perform specific actions in a smart contract, tokens that resemble shares or bonds, and even synthetic tokens that can track the price of any real-world asset.

In decentralized exchanges, users do not need to deposit their funds which is the case with centralized exchange. Instead, users maintain control of their assets until the trade is executed. Trade execution happens atomically through a smart contract, meaning that both sides of the trade are performed in one indivisible transaction, mitigating the counterparty credit risk. Depending on the exact implementation, the smart contract may assume additional roles, effectively making many intermediaries such as escrow services and central counterparty clearing houses (CCPs) obsolete.

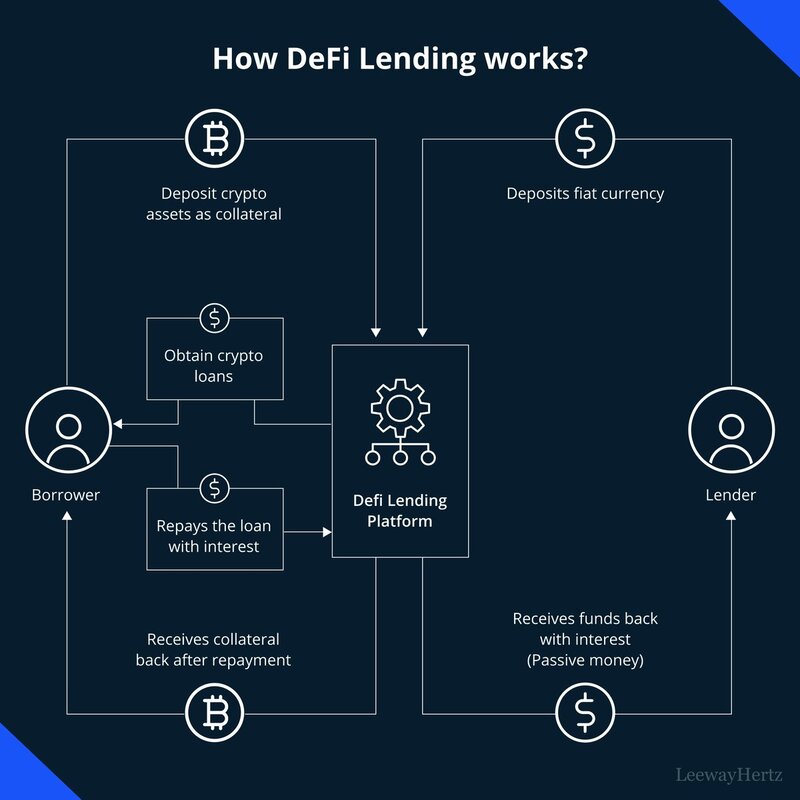

Decentralized lending platforms and loans are an essential part of the DeFi ecosystem. Defi loans do not need to rely on trusted relationships via one of two methods. One method is credit being provided under the condition that the loan must be repaid atomically, meaning that the borrower receives the funds, uses, and repays them—all within the same blockchain transaction. A second way is loans can be fully secured with collateral. The collateral is locked in a smart contract and only released once the debt is repaid.

One type of collateralized loan platforms allow the user to create collateralized debt positions; in other words the user gets new tokens back by collateral locked in smart contract (or in the example below, just USD). For example MakerDAO is a decentralized protocol that is used to issue the USD-pegged Dai stablecoin. First, the user deposits ETH in a smart contract classified as a collateralized debt position (CDP) (or vault). Subsequently, they call a contract function to create and withdraw a certain number of Dai and thereby lock the collateral.

Decentralized derivatives are tokens that derive their value from an underlying asset's performance (tokenized versions of stocks, precious metals, alternative crypto assets), the outcome of an event, or the development of any other observable variable.

For on-chain asset management whenever someone invests in an on-chain fund, the corresponding smart contract issues fund tokens and transfers them to the investor's account. These tokens represent partial ownership of the fund and allow token holders to redeem or liquidate their share of the assets.

In summary, the opportunities of DeFi are based on

- Efficiencies: While much of the traditional financial system is trust based and dependent on centralized institutions, DeFi replaces some of these trust requirements with smart contracts. The contracts can assume the roles of custodians, escrow agents, and CCPs.

- Transparency: All transactions are publicly observable and smart contract code can be analyzed on chain.

- Accessibility: Theoretically open to anyone, the risk of discrimination is almost inexistent due to lack of identities.

- Composability: Any two or more pieces can be integrated, forked, or rehashed to create something entirely new. Anything that has been created before can be used by an individual or by other smart contracts. This flexibility allows for an ever-expanding range of possibilities and unprecedented interest in open financial engineering.

The risks include:

- Smart contract execution: Users have to be aware that the protocol is only as secure as the smart contracts underlying it; leaving it vulnerable to coding errors or exploration (by analyzing the transparent underlying code). Most users won't be able to read contract code, understand its potential security concerns, or understand the data payload - and there is no central administration to adjudicate issues or risks (although there are insurance and other similar services).

- Operational security: While blockchains are permissionless and not reliant on a central government or authority; ironically governance and some control is often held by a small groups of people (usually the project's core team) and smart contracts are reliant on external data.

- Illicit activity: Pseudonymity can be abused by actors with dishonest intentions. Regulators can (or should) regulate a decentralized infrastructure, there are two areas that deserve special attention, namely, fiat on- and off-ramps and the decentralization theater.

- Scalability: (This is why I am intrigued since by Solana which is built with native parallelism; Solana scalability >> Ethereum scalability)

DeFi has unleashed a wave of innovation. On the one hand, developers are using smart contracts and the decentralized settlement layer to create trustless versions of traditional financial instruments. On the other hand, they are creating entirely new financial instruments that could not be realized without the underlying public blockchain. Atomic swaps, autonomous liquidity pools, decentralized stablecoins, and flash loans are just a few of many examples that show the great potential of this ecosystem.

RSS Feed

RSS Feed