from when I worked at enterprise Software as a Service companies

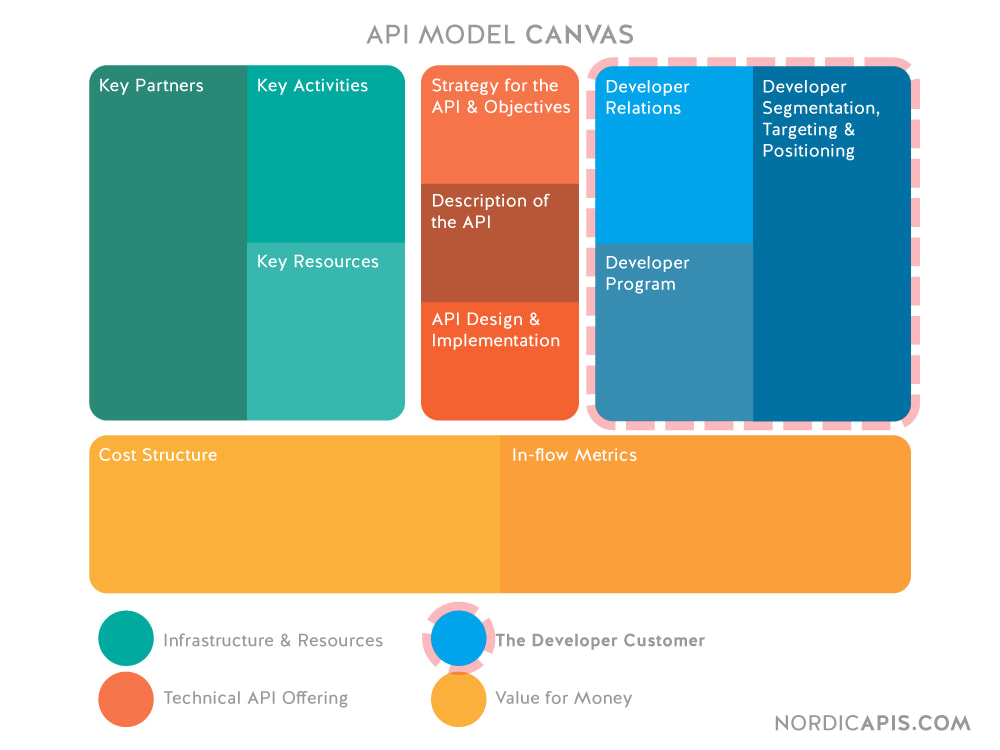

Technology Providers: Supply capabilities used in SaaSCo's offering

Provide services required for a specific market or product

- Database technology providers

- Hosting / cloud providers

- Information / data providers

Owned by Technology and Operations organizations

Non exclusive relationships

Service Providers: Implementation, support, etc. for a specific market

- System Integrators (SI) for a specific region or for a specific software package

- Support services for a given market (such as a language / country where SaaSCo's in-house support not available)

- MSP - managed service providers (overlap with technology providers as could be outsourced IT)

Owned by the department at SaaSCo that usually provides this service such as implementation or support team

Relying on expertise in market or product type so exclusivity unlikely unless referral or resell involved

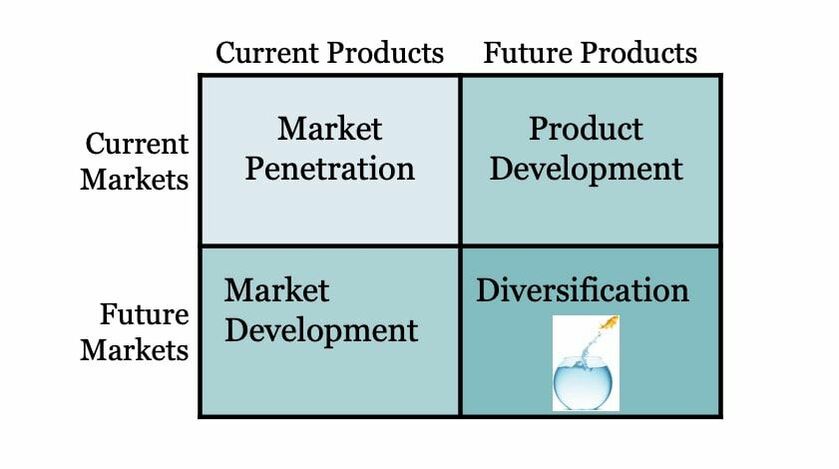

Go-to-Market Referral or Distribution Resell Channel Partners:

Assist in selling SaaSCo's offering in given market (region or segment) or channel

- Affiliate marketing

- Referral partner

- (Value Added) Resellers

- Online marketplaces

Owned by Marketing and Sales teams; and specifically Channel Sales & Marketing

Most likely involves exclusivity for SaaSCo’s market

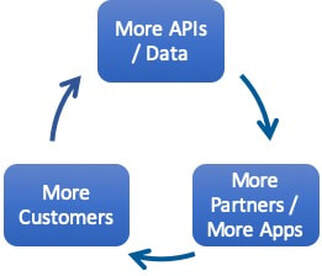

Product Partners (ISV - Independent Software Vendor)

Enhance client offering

- Provides key capability or offering that is needed to help sell SaaSCo’s offering for given market or segment

- Helps create an ecosystem which is a broader value proposition to the client

For one SaaS company approximately 3/4 of clients said presence of a partner ecosystem and the promise that a wider base of solutions than just SaaSCo's solution was a principle reason they picked the (higher priced) SaaSCo offering. According to CrossBeam, one company had 34% higher annual contract value (ACV) on deals done with product partners.

Owned by Product organization

Exclusivity in resell model but less likely in referral model

Although! Often there are overlaps across these categories

- System Integrators (especially Global System Integrator GSIs) can also refer or resell products which they integrate.

- Product partners can also be referral partners encouraging clients who do not already have SaaSCo’s product to use it as it makes their offering more compelling and valuable. In this case the channel sales team will own or at least dictate the terms of the referral agreement with the Product Partner, even if the product partnership team is the lead.

- Distribution partners can be white label partners integrating SaaSCo's solution with their own offering; but partnership must be enabled in conjunction with product teams market offering strategy.

There is a big gap between these two product partnership models because in the resell model SaaSCo owns the revenue and the risk!

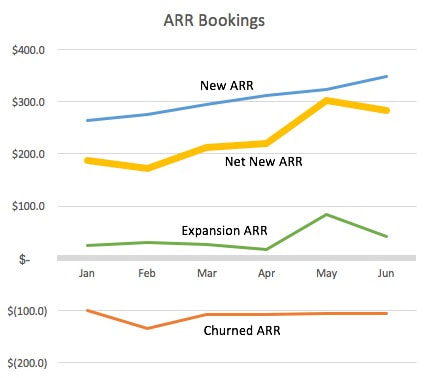

Referral

Enables solutions and sales for SaaSCo especially with regional / vertical opportunities; drives some revenue

- Percentage (with minimums) of what partner charges for a “connector” to the SaaS company’s services or data

- and / or a portion (maybe roughly 1/4) of the total offering that the partner charges - depending on how much SaaSCo needs the client's solution to more effectively sell their own (for example a partner's compliance offering that is required to sell SaaSCo's offering in a certain market).

- Also a one-time referral fee for a partner offering purchased by SaaSCo clients.

Access to basic marketing mostly focused around SaaSCo’s marketplace or “App Store” listing

Limited sales support into SaaSCo sales organization and client base

Minimum support other than integration

No/minimal influence on partner's product development roadmap

Premium Referral program could involve additional fees from partner for specific additional marketing and sales opportunities

Minimum risk vetting since not on SaaSCo paper (not a SaaS company contract); although realizing SaaSCo brand still takes some risk if there is referral

Resell

New product offering for SaaSCo; driving significant revenue

- Negotiated percentage of partner core offering list price (very roughly in 50% range although this could vary widely depending on which party is responsible for which activities - such as support; and which party more needs the other party - who has the power!)

- Aspects of deal may include certain exclusivity (regions, accounts), sales channel conflict avoidance strategies such as double commission, list price discounts, and SaaSCo committed volumes.

Negotiated co-marketing; and SaaSCo marketing like other SaaSCo’s products.

Sold like other SaaSCo product with customer / market restrictions and minimum volumes negotiated as part of deal.

Support negotiated but generally Level 1 and Level 2 support by SaaSCo and detailed Level 3 support by partner.

Influence on partner's product development roadmap potentially negotiated as part of deal.

Premium resell may be white labelled where SaaSCo has exclusivity across larger markets and owns more of partner roadmap.

Since on SaaSCo paper, need to do full risk review and create processes across entire operations between partner and SaaSCo

As a reminder!

Partners want access to data and functionality and access to brand, marketing, sales teams, and clients.

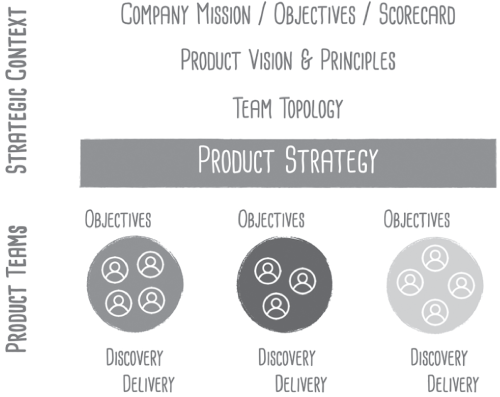

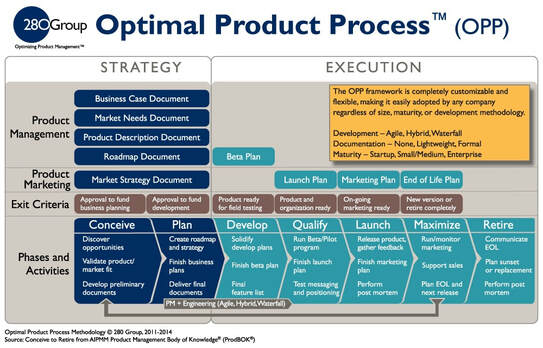

Product and Partner Development

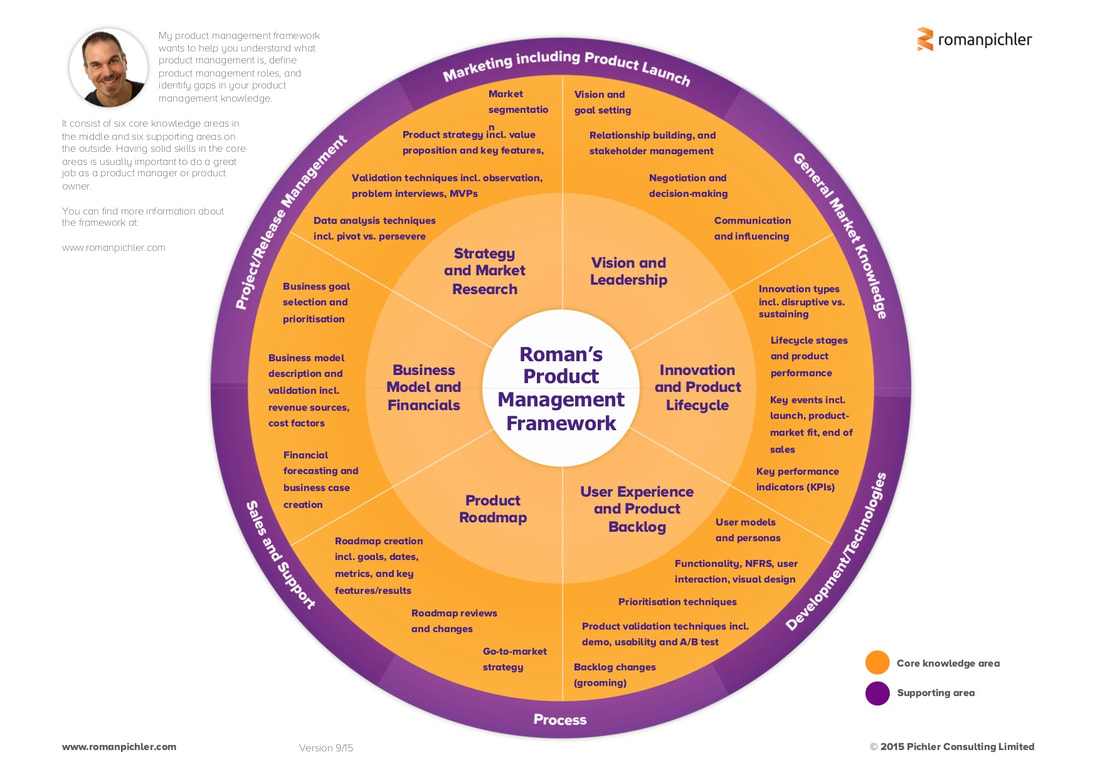

- Product Management: Building business models and APIs and other product offerings needed to deliver on identified partner enabled use cases. Working with Technology organization and other product managers.

- Business Development: Recruitment and contract negotiation of targeted partners and categories. Working with Corporate business development and corporate partnerships. Can also work with corporate M&A group as a partnership pipeline is being created: referral partners are good candidates to become resell partners; and resell partners are good candidates for potential acquisition.

- Technical Enablement: Helping partners build the identified integrations and applications. Working with global support.

Partner Success and Partner Revenue

- Marketing: Helping clients, prospects, and sales teams understand the value proposition of partner solutions. Working with corporate and regional marketing.

- Alliance and Sales: Partner account management; and advocating for partner solutions to be sold to specific customers and to be integrated with specific SaaSCo prospect opportunities. Working with regional sales.

- Services: Application implementations and partner customer support; also billing and revenue tracking. Working with global support and operations

RSS Feed

RSS Feed